PRESS RELEASE – March 20, 2019

- Alliance Intelligent Cloud built on Microsoft Azure to power the Alliance’s latest connected services

- World’s leading automotive alliance to use Alliance Intelligent Cloud for connected infrastructure in nearly all 200 markets served by Renault, Nissan and Mitsubishi

- Alliance Intelligent Cloud to power the connected services in the all-new Renault Clio and the Nissan Leaf in Europe and Japan later this year

(Paris/Yokohama/Tokyo) Renault-Nissan-Mitsubishi, the world’s leading automotive alliance, today announced the production release of the Alliance Intelligent Cloud, a new platform that is enabling Renault, Nissan and Mitsubishi Motors to deliver connected services in vehicles sold in nearly all 200 markets served by the Alliance member companies. Culminating joint development efforts between the Alliance and Microsoft, the auto industry’s first global and most ambitious connected vehicle program will be deployed utilizing cloud, artificial intelligence (AI) and IoT technologies provided by Microsoft Azure. Azure provides the Alliance with a global data platform to securely capture, manage and analyze vehicle data to deliver intelligent services based on the vast volume of data created by connected vehicles.

Kal Mos, Global Vice President of Alliance Connected Vehicles at Renault-Nissan-Mitsubishi, said: “Today we are deploying a vehicle connectivity platform that will transform the digital experience for customers of Renault, Nissan and Mitsubishi. Through our collaboration with Microsoft, we are introducing the most powerful and far-reaching connected vehicle platform. Leveraging the size and scale of the Alliance, we have built an intelligent cloud platform that sets the pace for our industry.”

“Renault-Nissan-Mitsubishi is a longstanding partner and our first strategic partner for the Microsoft connected vehicle platform.” said Jean-Phillipe Courtois, EVP and President, Microsoft Global Sales, Marketing & Operations at Microsoft. “Today’s production release of the Alliance Intelligent Cloud enables a new generation of connected services powered by Microsoft Azure to come to market.”

The first vehicles produced with Alliance Intelligent Cloud technology will be the all-new Renault Clio and selected Nissan Leaf models sold in Japan and Europe. These are also the first vehicles powered by the Microsoft connected vehicle platform available to consumers at scale.

Vehicles utilizing the Alliance Intelligent Cloud will benefit from seamless access to the internet, providing enhanced remote diagnostics, continuous software deployment, firmware updates as well as access to infotainment services.

The Alliance Intelligent Cloud is a highly-scalable platform and will consolidate multiple legacy connected vehicle solutions with current and future connected car features and business operations that will support mobility services. The data-driven platform will enable advanced AI and analytics scenarios and accelerate time to market for new innovations and business initiatives.

Optimized for speed and efficiency, the Alliance Intelligent Cloud will connect to vehicles and share digital features and future innovations across multiple models and brands for consumers in different regions around the world. Features consolidated onto the connected platform include remote services, proactive monitoring, connected navigation, connected assistance, over-the-air software updates and other customer tailored services.

The Alliance is taking a unique approach to addressing the business opportunity provided by connected vehicles by owning, operating and designing its own intelligent cloud platform on Azure.

The Alliance Intelligent Cloud is capable of connecting Alliance vehicles with future smart cities infrastructure as it develops and with potential future partners. With this new initiative, any third-party seeking to connect with all legacy and future connected Alliance vehicles will have a single point of contact to partner with.

ABOUT RENAULT-NISSAN-MITSUBISHI:

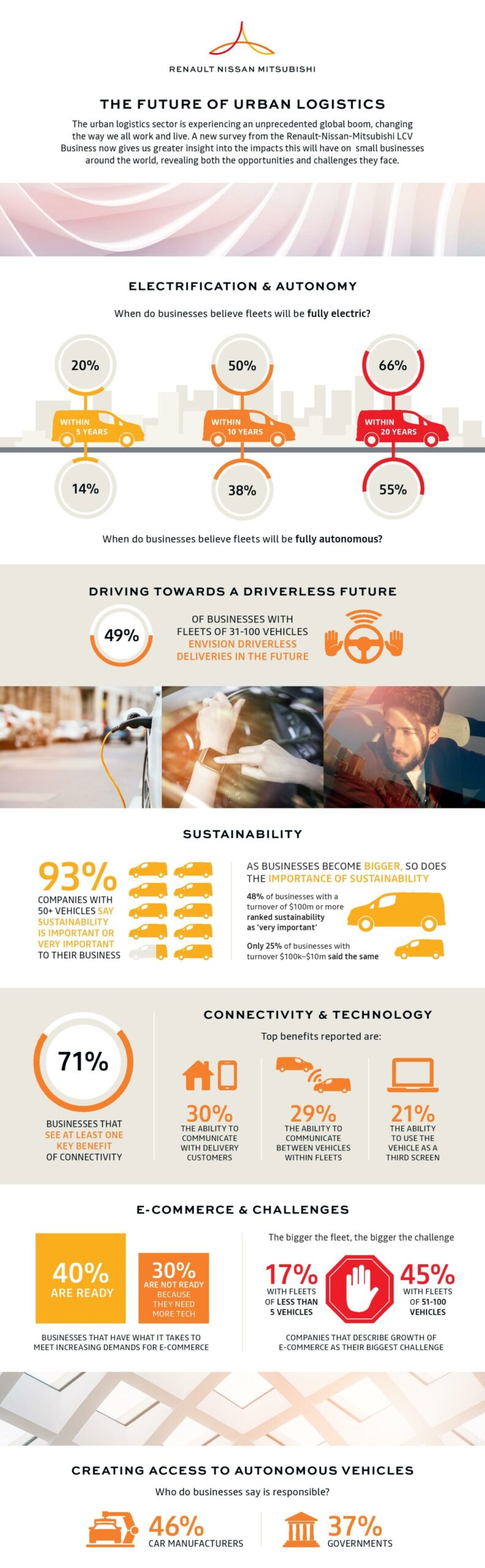

Groupe Renault, Nissan Motor Company and Mitsubishi Motors represent the world’s largest automotive alliance. It is the longest-lasting and most productive cross-cultural partnership in the auto industry. Together, the partners sold more than 10.7 million vehicles in nearly 200 countries in 2018. The member companies are focused on collaboration and maximizing synergies to boost competitiveness. They have strategic collaborations with other automotive groups, including Germany’s Daimler and China’s Dongfeng. This strategic alliance is the industry leader in zero-emission vehicles and is developing the latest advanced technologies, with plans to offer autonomous drive, connectivity features and mobility services on a wide range of affordable vehicles.

NEWSROOMS

Alliance – English

Groupe Renault – English

Groupe Renault – French

Nissan – English

Nissan – Japanese

Mitsubishi Motors – English

Mitsubishi Motors – Japanese

ABOUT MICROSOFT:

Microsoft (Nasdaq “MSFT” @microsoft) is the leading platform and productivity company for the mobile-first, cloud-first world, and its mission is to empower every person and every organization on the planet to achieve more.

This press release features more medias: Download PDF